Why EU Telcos and Banks Can Benefit from a Smart Middle

In the fast-evolving world of device financing where Telcos seek to provide flexible device upgrade and return programs, one detail holds the power to shape everything from compliance costs to customer lifetime value: who owns the device?

At first glance, it sounds simple. But under Europe’s updated Consumer Credit Directive (CCD2), it’s anything but, and EU Member States are required to put CCD2 into national law by November 2025 (less than 6 months), with the regulations required to apply starting November 2026.

The question of who legally owns a financed device does not just shape logistics—it defines risk, compliance exposure, balance sheet implications, and customer experience.

Banks that finance phones, tablets, and other connected devices often prefer to stay in a pure credit role—underwriting risk, collecting payments, and staying out of hardware ownership. If they mistakenly stepping into device ownership, that can mean dealing with insurance claims, capital provisioning and product defects.

Yet, programs like “Upgrade Anytime” or “Trade-In for Credit” cannot function without someone owning the device. These types of upgrade, trade-in and device-as-a-service (“DaaS”) programs, which have been gaining traction globally, make the path from checkout to lifecycle management more complex and run the risk of blurring the lines between ownership, use, and trade-in.

Someone must be the owner.

That someone should not be the Bank unless they want to assume new risks, operational overhead, inventory tracking and liability for customer disputes. That’s not just a potential compliance headache—it risks customer trust.

That someone should also not be the Telco, as it could blur the line between “seller” and “creditor”, especially in the consumer’s eyes. Under CCD2, if the credit and the sale are closely linked, the Telco might be treated as a credit intermediary, triggering registration and joint liability with the bank if the funding is used solely to finance the device. In the end, the Telco would need to build, or expand, legal infrastructure in each country to address the credit burden.

This is where the model could breaks—or scale with the right type of partner for both the Bank and Telco.

Enter LiftForward.

LiftForward is a globally-proven third-party software platform that can sit between Banks and Telcos to absorb the operational complexity—allowing Banks to focus on lending and Telcos to focus on strong customer relationships.

It’s not just about compliance. It’s about protecting the customer journey, trust and loyalty.

If ownership is not handled cleanly, what could be a great opportunity for an upgrade and repeat purchase, could turn into a dispute over returns, damaged devices, or unexpected fees—eroding loyalty, damaging brand perception, and cutting short customer lifetime value.

With LiftForward in the middle:

- Telcos get scalable programs across borders without legal sprawl.

- Banks maintain their clean credit frameworks without asset exposure.

- Customers get the seamless experience they expect.

Sometimes the best growth decision is knowing what not to own…or at least having the simple option to make that choice.

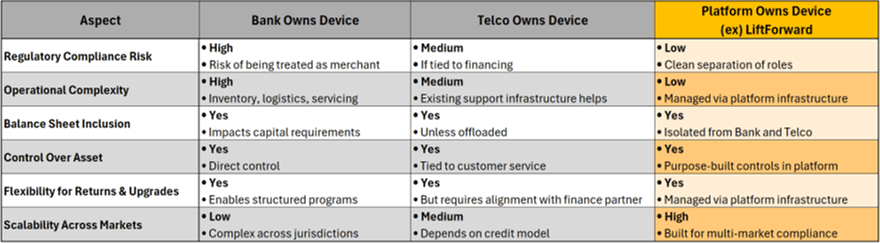

Below is a quick summary of the Ownership options between Bank, Telco and platforms like LiftForward. Let me know if you would like a more detailed overview of the approach.

#DigitalTransformation #TelcoStrategy #ConsumerFinancing #EmbeddedFinance #CCD2 #DevicePrograms #CustomerExperience #FintechInnovation #LiftForward #BankingSimplified